401k rate of return calculator

The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. Calculator Definitions Annual salary.

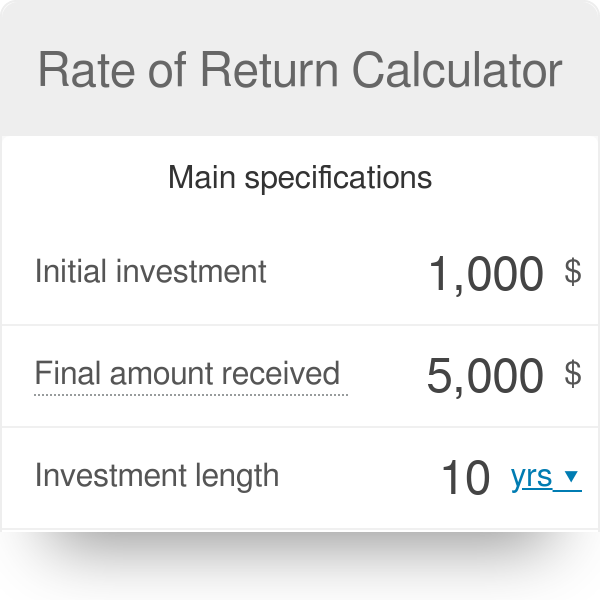

Rate Of Return Calculator

Your annual savings expected rate of.

. Then divide by the beginning balance from. A 5 rate of return in retirement assuming a more conservative portfolio. Annual Rate of Return.

This calculator assumes that your return is compounded annually and your deposits are made monthly. To calculate the annual rate of return on 401k take the final amount and subtract any commitments you made over the past year. An investment calculator is a simple way to estimate how your money will grow if you keep investing at the rate youre going right now.

First all contributions and earnings to your 401 k are tax deferred. Many retirement planners suggest the typical 401 portfolio generates an average annual return of 5 to 8 based on market conditions. A 401 k can be one of your best tools for creating a secure retirement.

You can look at the funds performance over several years. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. It provides you with two important advantages.

You can use this calculator to help you see where you stand in relation to your retirement goal and map out. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. Age of Retirement Current Age.

To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial situation. If you dont have data ready. To help estimate whether youre on the right track for a comfortable retirement its important that you periodically use a 401k rate of return calculator to evaluate your accounts.

For some investors this could prove. What is a good 401 k rate of return. The actual rate of return is largely.

Your Employers Monthly 401k Adding. Your Monthly 401k Contribution. If your retirement account is in a fund you can look at the funds prospectus to see what the current expected rate of return is.

It simulates that if you. The annual rate of return for your 401 k account. Use this calculator to determine how much monthly income your retirement savings may provide you in your retirement.

But your 401 return depends on. But rememberan investment calculator doesnt. This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay Weekly Bi-Weekly Semi-Monthly Monthly your contribution and.

Using this retirement calculator First enter your current age income savings balance and how much you save. This 401k contribution calculator helps streamline the process of figuring out how much you should contribute toward your 401k to meet your future goal. The average 401 k rate of return ranges from 5 to 8 per year for a portfolio thats 60 invested in stocks and 40 invested in bonds.

Your retirement is on the horizon but how far away.

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

Retirement Services 401 K Calculator

Rate Of Return Formula Calculator Excel Template

Achieving The Two Spouse Early Retirement Household

How To Calculate The Annual Rate Of Return On A Bond Our Deer Bond Annual Finance Advice

Different Methods To Navigate A Fluctuating Commercial Real Estate Market Commercial Real Estate Marketing Commercial Property Commercial Real Estate

Tax Calculator Tax Preparation Tax Brackets Income Tax

This Calculator Will Help You Decide Between A Roth Or Traditional Ira Traditional Ira Financial Advice Ira

Retirement Withdrawal Calculator For Excel

Pin On Financial Trading

Free 401k Calculator For Excel Calculate Your 401k Savings

All You Need To Know About 401k Dr Breathe Easy Finance Finance Investing Investment Quotes Investing

401k Calculator

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Here Is What You Could Expect In Retirement If You Use A 401k Tsp 403b 457 Or Ira As Your Retirement Investment Investing For Retirement Investing Stock Market

The Only Reasons To Ever Contribute To A Roth Ira It S Generally Better To Never Pay Taxes Up Front If Yo Finance Blog Wealth Management Funny Marriage Advice

Customizable 401k Calculator And Retirement Analysis Template